A lien is a legal claim on an asset used as collateral against a debt. A lien can be attached to an asset, like a home, by a creditor or a legal judgment. The lien is a way to guarantee payment of a financial obligation. If that financial obligation is not met, such as repaying a loan, then the creditor may seize the object of the lien.[1]

So, for example, A loan may be acquired to make a major purchase, and a lien placed on the borrower’s home. If the borrower doesn’t pay the loan, the creditor can sell the home, the subject of the lien, to satisfy the debt. The only way to remove a lien on an asset is to pay off the debt.

There are three types of liens: bank, real estate, and tax.[1]

A bank lien is used when a borrower secures a bank loan to buy a vehicle, land, or a home. The bank puts a lien on the item and if the borrower does not repay the loan, the bank can repossess the asset and sell it to recover the debt. If, however, the borrower repays the loan, the lien is released, and the item is owned free and clear of any liens.[1]

A tax lien is used by the government on a person’s assets if they are delinquent in paying their taxes. Tax liens may be placed against bank accounts, homes, vehicles, or other significant assets. If the tax debt is not satisfied, the government can sell the assets.[1]

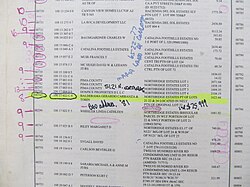

A real estate lien is used when a home buyer or owner takes out a mortgage on their home. The financial institution or individual who lent the money will place a lien against the house. Once the mortgage is paid off, the lien is removed. Other types of real estate liens can be also be placed against a house.[1]

Liens and genealogy recordsLiens and genealogy records

Notice of an ancestor's delinquent taxes, purchases or foreclosures of property or a home might be found in the legal notices of their community’s newspaper. Land or property records may also include a lien. Historical newspaper articles, land and property records should be sought.

Lien documents or mentions of an ancestor not satisfying a debt will provide insight into their financial life and help make sense of troubles they faced. Genealogically relevant information may be limited to their name, date, and residence.

See alsoSee also

Explore more about LiensExplore more about Liens

- Sharecropping Contracts, Chattel Mortgages and Trust Deeds webinar at Legacy Family Tree Webinars